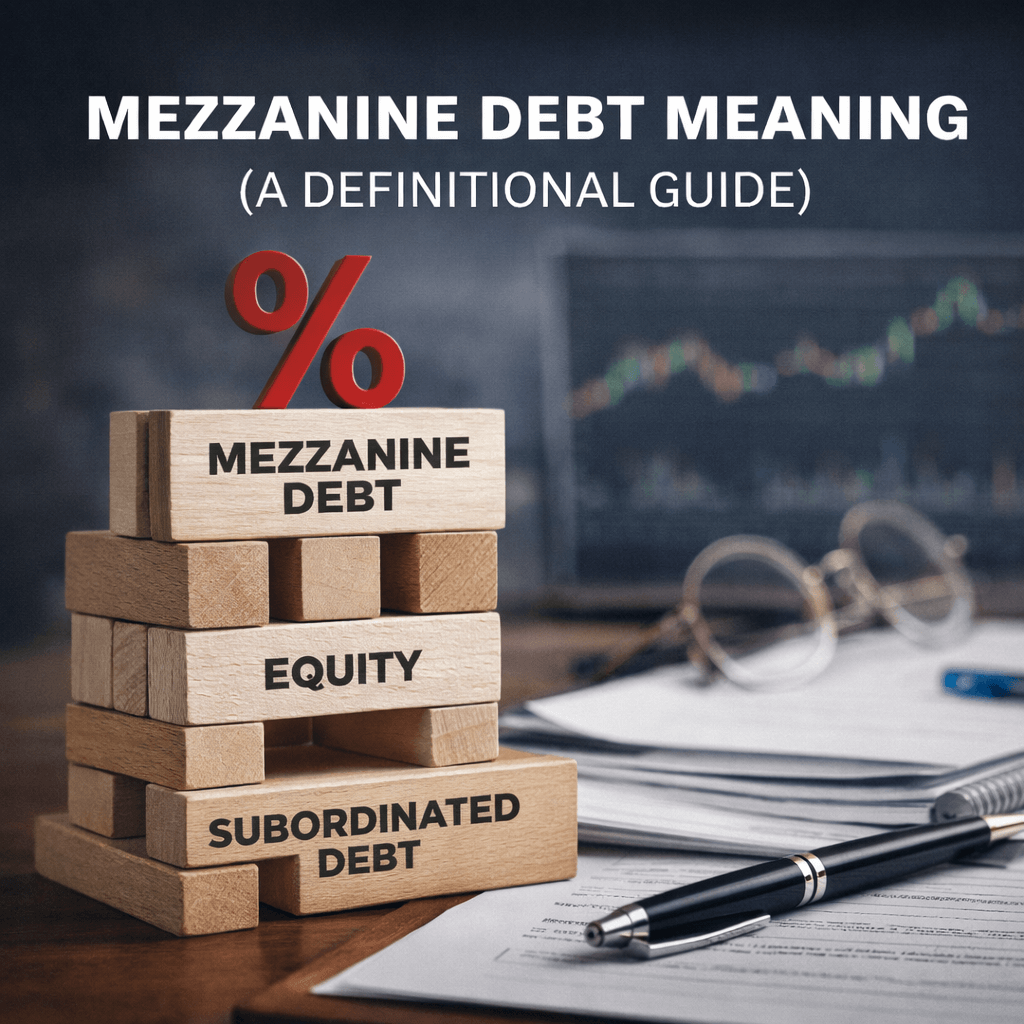

Mezzanine Debt Meaning (A Definitional Guide)

Background

Mezzanine debt is a flexible financing tool that sits between senior debt and equity, typically secured by ownership interests rather than the property itself. In New York commercial real estate transactions, it bridges critical funding gaps—unlocking leverage, preserving equity, and enabling projects that might not otherwise move forward. For lenders, mezzanine loans offer enhanced yields and a defined path to control, but enforcement of UCC remedies—such as foreclosures on equity interests and intercreditor priority disputes—can introduce significant risk. These considerations make careful structuring and informed negotiation essential for all parties.

Table of Contents

How Mezzanine Debt Functions in Real Estate

Mezzanine debt is a strategic financing tool that bridges the gap between senior debt and equity, delivering additional capital without placing a lien on the real property. Instead, it is typically secured by a pledge of the borrower’s ownership interests and governed by the UCC, making proper perfection of the equity collateral critical. In large commercial developments—where senior lenders cap leverage—mezzanine financing preserves equity while unlocking project viability. That flexibility comes with risk: borrowers face higher costs and potential loss of control through a UCC foreclosure, while lenders rely on intercreditor protections and collateral value to enforce priority. When structured correctly, mezzanine debt can be a powerful catalyst for complex real estate transactions.

Key New York Legal Requirements

Mezzanine debt is typically secured by a pledge of the borrower’s equity interests, with lenders perfecting their security through UCC filings rather than recorded mortgages. Because enforcement is governed by UCC foreclosure rules, missteps in perfection or procedure can undermine priority, delay enforcement, and stall a project’s financing and construction timeline. Careful structuring and execution of mezzanine financing is therefore essential to protect rights, avoid costly delays, and keep projects moving forward.

When to Contact The West Firm

When mezzanine financing is on the table, often triggered by capital stack restructurings, refinancings, or equity transfers, early legal guidance is critical. Perfection and intercreditor missteps, documentation or compliance errors, and UCC foreclosure exposure can undermine priority, delay closings, and disrupt project timelines. Because mezzanine financing touches every layer of the capital stack, careful structuring is essential to manage enforcement risk and keep projects on track. The West Firm is uniquely qualified to guide lenders, developers, and owners through these complexities with confidence.

-

A mezzanine foreclosure targets the owner’s equity interests rather than the real property itself and is governed by Article 9 of the UCC, not real property law. By contrast, traditional mortgage foreclosures are secured by property liens and follow state foreclosure statutes—making mezzanine enforcement faster, more technical, and highly dependent on precise structuring.

-

Failure to properly perfect a mezzanine lender’s security interest under Article 9 of the UCC can mean lost priority, loss of foreclosure rights, and an effectively unsecured loan. These missteps weaken enforcement leverage, delay recoveries, and can fundamentally undermine the economics of the transaction, making precision in structuring and perfection essential.

-

Mezzanine loans can unintentionally slow projects when covenants, consent rights, or intercreditor agreements delay approvals for budgets, funding, or schedule changes. When financing begins to interfere with governance or execution, strategic legal guidance can streamline decision-making and keep the project moving forward.

.png?content-type=image%2Fpng)